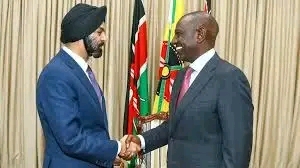

When the World Bank talks about raising taxes, Kenyans hear one thing — life is about to get harder.

In its latest advisory, the Bank urged Kenya to consider increasing VAT and excise duty to help clear over KSh526 billion in pending bills. It argues that paying off these debts would restore fiscal stability and free up funds for development.

But for many Kenyans already battling high fuel prices, job losses, and stagnant incomes, the timing couldn’t be worse.

Lobby groups such as the Motorists Association of Kenya (MAK) have joined citizens in opposing the idea, warning that taxing essentials like fuel, gas, and electricity would drive up prices on nearly everything. For low-income earners and hand-to-mouth households, even a small tax increase could mean skipping meals, delaying school fees, or falling deeper into debt.

Critics like lawyer Peter Wanyama say Kenya’s problem isn’t a lack of revenue — it’s poor spending discipline. Billions are lost to corruption and inefficient projects.

Instead of burdening citizens further, experts argue the government should cut wasteful spending, enforce transparency, and invest in productive sectors that grow jobs and expand the tax base naturally.

According to the Kenya National Bureau of Statistics, inflation stood at about 5.7% in September, driven mainly by food and fuel prices. More taxes would only add pressure to household budgets while cooling demand across the economy.

For investors, that could mean slower consumer spending, tighter profit margins, and uncertainty in sectors like retail, transport, and manufacturing.

The smarter fix lies in efficiency, not extra levies — sealing revenue leaks, auditing stalled projects, and supporting small businesses that power local growth.